Questions? Give us a call

Fixed Indexed Annuity

What is a Fixed Indexed Annuity?

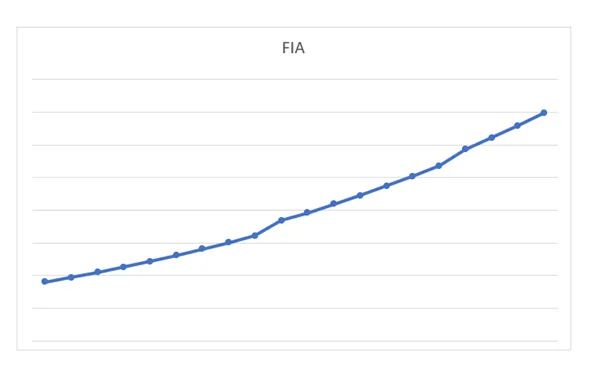

A fixed indexed annuity, or FIA, is a retirement product that provides you a guaranteed income stream for life.

How does a Fixed Indexed Annuity work?

FIAs are offered by insurance companies. Either a lump sum or multiple payments are deposited into the annuity and then the insurance company invests that money and credits interest to your annuity. Unlike a 401k, the insurance company absorbs the risks of market downturns - guaranteeing you will receive at least what you paid to purchase it.

Is a Fixed Indexed Annuity right for me?

Like any investment product you need to make sure it is a good fit for your financial portfolio. You need to understand the product features, and that the benefits align with your goals. A great way to verify this is to talk to a properly licensed financial professional.

An FIA may be right for you if you:

- ✅are looking to diversify your portfolio

- ✅want a guaranteed income stream during retirement

- ✅want growth potential without the risks of market downturns

- ✅like safety

- ✅are tired or fearful of market fluctuations and volatility

- ✅do not have a FIA product in your portfolio already

Pros VS Cons

Pros

➕ Guaranteed Income Stream

➕ Diversification

➕ Principal is secure

➕Participate in upside market gains with no downside risk

➕ Tax-deferred growth

➕ No annual management fee

➕ Liquidity – flexible withdrawal privileges

➕ Higher return than CDs, money markets, savings accounts, and bonds

➕ Unlimited contributions

➕ Inheritance -bypass probate by passing money directly to heirs

➕ Safety

➕ It is possible during a down year (or years) to have zero-interest crediting

➕ In contrast variable products and market products would draw a negative balance in down years, a fixed index annuity would lose nothing.

➕ FIA are backed by highly regulated state insurance companies

➕ Long-term savings solution

➕ Backed by state guaranty programs

➕ Income Riders available (on certain products)

➕ Premium bonus riders available (on certain products)

Cons

➖10% IRS penalty on withdrawals prior to 59 1/2 years of age (this applies to any retirement accounts including 401k and IRAs)

➖ Early withdrawal penalties or surrender charges for large withdrawals prior to maturity or when withdrawing in excess of the 10% annual surrender-free portion

➖ Ordinary income tax owed on earnings during the withdrawal or income payout stage

➖ Fixed index annuities are not FDIC insured

➖ Fixed index annuities do not capture the full upside of the stock market

➖ Caps, participation rates, spreads, and declared fixed interest rates are all subject to change on an annual basis

➖ It is possible during a down year or years to have zero-interest crediting

➖ Some carriers returns are capped, meaning there is a limit on how much you gain in a year

I have a 401k. Why would I need a Fixed Indexed Annuity?

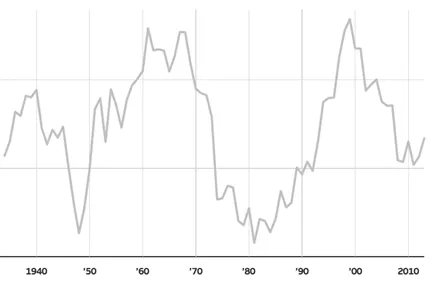

Having a 401k is a key component of a strong retirement plan and a good vehicle for growing your retirement while you are working. However, as one gets closer to their retirement years diversifying your portfolio to balance the risks and growth is a wise move. When you have a shorter time horizon, meaning less years until retirement, you have less time to recover if the market was to take a dip, have a recession, or a hiccup. This can be financially devastating to a portfolio.

FIAs are a smart way to minimize risk for retirees who cannot afford to lose their hard-earned money. FIAs are about preserving what you have accumulated from your working years and growing it with no risks.

If I want to learn more about Fixed Indexed Annuities, where do I begin?

Individuals interested in learning more about FIA should speak to a licensed financial professional for assistance. We would be happy to assist you on your retirement journey. Give us a call at 270-904-6070 for professional help today or click the button below.

Safeguard Insurance, LLC

Copyright 2022 -- All Rights Reserved

Insuring your health, life, and retirement.

Phone: 270-904-6070

Email: education@safeguardky.com

1600 Scottsville Rd, Suite 100

Bowling Green, KY 42104

The information presented on this website is for informational or illustrative purposes only. Safeguard Insurance is operated by licensed insurance agents who can help you enroll in an insurance policy. Safeguard Insurance, and any agents or employees, are not affiliated with or endorsed by the United States government, Medicare, or the Social Security Administration. We do not offer every plan available in your area, and any information we provide is limited to those plans we do offer in your area. Please get in touch with Medicare.gov or 1-800-MEDICARE to get information on all your options. When you request to be contacted about Medicare Advantage, Medicare Part D, or Medicare Supplement plans, you acknowledge that a licensed insurance agent may contact you by phone, email, mail, or in-person to offer additional assistance or to discuss all your Medicare health insurance options.

Safeguard Insurance provides content (via blog posts, YouTube videos, podcasts, eBooks, and any other manner) as a service to its readers. Safeguard Insurance does not offer legal or tax advice. Safeguard Insurance cannot guarantee the accuracy or suitability of our content for a particular purpose without a full and thorough fact finder. We are not responsible for any actions taken by users.