Questions? Give us a call

How to Apply for Medicare when turning 65

Knowing when, how, and where to enroll in Medicare can be confusing. Signing up for Medicare at age 65 is not exactly the same process as signing up for Medicare after age 65.

If you are already drawing Social Security benefits before turning 65 (for at least 4 months), you will automatically receive your Medicare Part A and Part B. You will receive your red, white, and blue Medicare card approximately 3 months before your 65th birthday. Your Medicare number is a unique number assigned to you. If your birthday falls on the 1st day of the month you will receive a Part A and Part B effective date for the month before your 65th birthday.

If you are already drawing Social Security benefits but are wanting to delay your Part B effective date you have to proactively defer it. You can find instructions in your letter that contains your Medicare card that is mailed to you.

If you are not receiving Social Security benefits at least 4 months before turning 65 you will need to actively enroll in Medicare. You WILL NOT be automatically enrolled. We find that starting early is beneficial. This allows time if a mistake was to occur. There are steps below on how you can enroll. You can apply for Medicare up to 3 months before your 65th birthday.

How to Apply Online for Medicare

To apply for Social Security retirement benefits and Medicare at the same time visit https://www.ssa.gov/retire.

If you are only looking to enroll in Medicare visit https://www.ssa.gov/benefits/medicare.

How to Apply in Person for Medicare

To apply for Medicare in person you can visit your local Social Security office. Go to https://www.ssa.gov to find an office near you.

How to Apply on the Phone for Medicare

You can call Medicare at 1-800-772-1213 (TTY: 1-800-325-0778) for personalized help getting enrolled in Medicare Part A and Part B.

Blog Post: How to Order a Replacement Medicare Card

How to Apply for Medicare after age 65

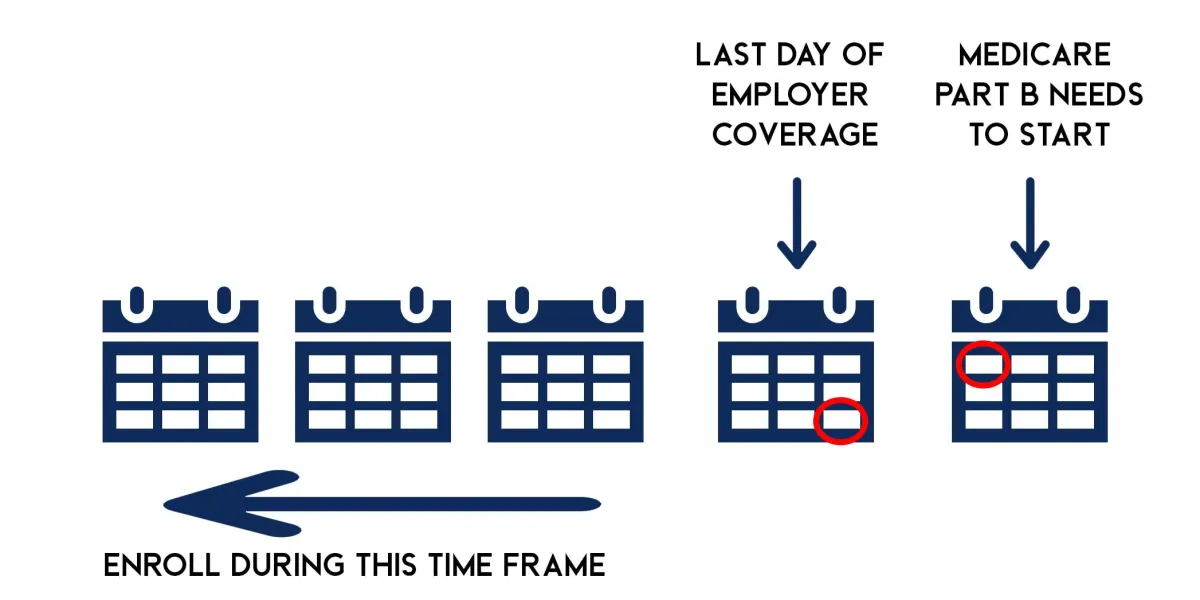

If you deferred Part B when you were first eligible at age 65 and now are ready to enroll in Part B coverage there are different steps to take.

If you are leaving creditable employer coverage you can enroll using a Special Enrollment Period (SEP).

This will prevent a lapse in coverage.

Once you have decided on your retirement date there are a few steps you need to take to get your Medicare Part B effectuated. Here are the steps you need to take:

-Complete the CMS L564 for employer verification.

The form will need to be filled out by your employer. The purpose of this form is to provide documentation to Social Security that proves that you have been continuously covered by a group health plan based on current employment, with no more than 8 consecutive months of not having coverage. If your employer went out of

business or refuses to complete the form, please contact Social Security about other information you may be able to provide to process your SEP enrollment request. This is needed so that you can enroll in Part B without a Late Enrollment Penalty. https://www.cms.gov/medicare/CMS-Forms/CMS-Forms/Downloads/CMS-L564E.pdf

-Complete the CMS 40B for Part B application.

This is the application to enroll in Part B. https://www.cms.gov/medicare/cms-forms/cms-forms/downloads/cms40b-e.pdf

-You can fax, mail, or drop your applications off in person at your local Social Security office for processing.

Do I have to apply for Part B?

If you are working past age 65 it is possible to delay Part B in certain circumstances. If you, or your spouse, will continue to be covered by health insurance from active employment (not COBRA) and your employer has more than 20 employees, and your employee coverage is deemed creditable by Medicare then you can defer your Part B without later being accessed a penalty for taking it. It is best to consult with your HR department at your place of employment to deem if your coverage is creditable. If it is not, then you need to enroll in Part B to avoid a penalty.

What happens if I miss my enrollment periods?

Remember that if you do not enroll in Medicare Part B during your Special Enrollment Period, you’ll have to wait until the next General Enrollment Period, which happens from January 1 to March 31 each year. Your Medicare Part B would be effective for July 1st. You may then have to pay a late-enrollment penalty for Medicare Part B because you could have had Part B and did not enroll. If you owe a late-enrollment penalty, you’ll pay an additional 10% on your premium for every 12-month period that you were eligible for Medicare Part B but didn’t sign up for it. You will pay this higher premium for as long as you’re enrolled in Medicare.

Safeguard Insurance, LLC

Copyright 2022 -- All Rights Reserved

Insuring your health, life, and retirement.

Phone: 270-904-6070

Email: education@safeguardky.com

1600 Scottsville Rd, Suite 100

Bowling Green, KY 42104

The information presented on this website is for informational or illustrative purposes only. Safeguard Insurance is operated by licensed insurance agents who can help you enroll in an insurance policy. Safeguard Insurance, and any agents or employees, are not affiliated with or endorsed by the United States government, Medicare, or the Social Security Administration. We do not offer every plan available in your area, and any information we provide is limited to those plans we do offer in your area. Please get in touch with Medicare.gov or 1-800-MEDICARE to get information on all your options. When you request to be contacted about Medicare Advantage, Medicare Part D, or Medicare Supplement plans, you acknowledge that a licensed insurance agent may contact you by phone, email, mail, or in-person to offer additional assistance or to discuss all your Medicare health insurance options.

Safeguard Insurance provides content (via blog posts, YouTube videos, podcasts, eBooks, and any other manner) as a service to its readers. Safeguard Insurance does not offer legal or tax advice. Safeguard Insurance cannot guarantee the accuracy or suitability of our content for a particular purpose without a full and thorough fact finder. We are not responsible for any actions taken by users.