Questions? Give us a call

What is a Medicare Supplement?

Medicare Supplements, also known as Medigap policies, are sold by private insurance companies to help you cover the out-of-pocket costs left behind by Medicare.

When you have a Medigap policy, Medicare pays up to its limit on your medical expenses. Then, your Medicare Supplement plan starts to help with covering costs up to the plan's limit. That limit usually covers what Medicare didn't, however, that will depend on which policy you select.

What do Medicare Supplements cover?

Original Medicare only covers 80% of your Part B expenses. The other 20% comes out of your pocket if you do not have a Medicare Supplement policy also referred to as Medigap. If you were to have a lengthy stay in a hospital or expensive treatments at outpatient facilities, you can see how that could add up.

Medicare Supplements pay that 20% for you.

Is there anything not covered by Medicare Supplement Plans?

Things that are not covered by Original Medicare on your Medicare Supplement:

- Routine dental, vision, and hearing exams

- Hearing aids

- Eyeglasses or contacts

- Long-term care or custodial care

- Retail prescription drugs

Which Medigap Plans Can I Choose From?

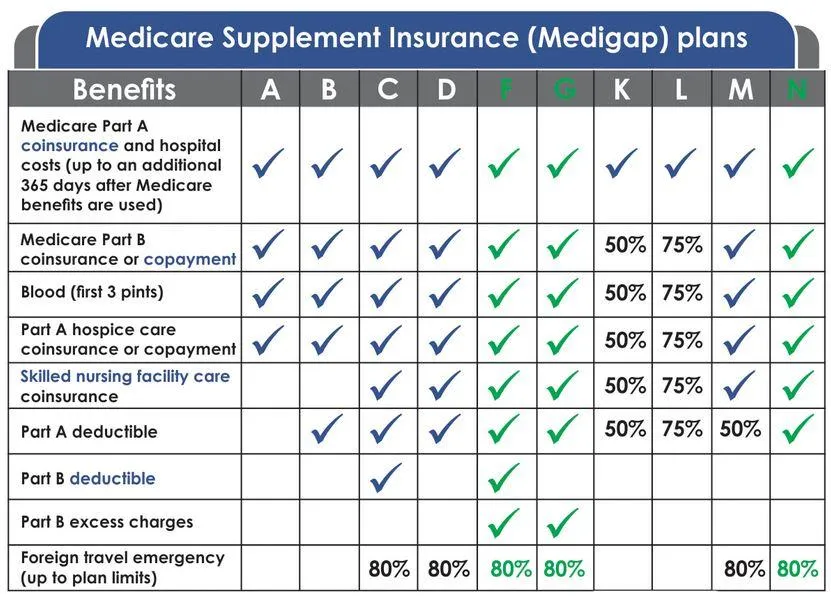

Plans that are highlighted in green above are the 3 most popular plans that clients choose when selecting a Medigap/Medicare Supplement plan.

Safeguard Insurance, LLC

Copyright 2022 -- All Rights Reserved

Insuring your health, life, and retirement.

Phone: 270-904-6070

Email: education@safeguardky.com

1600 Scottsville Rd, Suite 100

Bowling Green, KY 42104

The information presented on this website is for informational or illustrative purposes only. Safeguard Insurance is operated by licensed insurance agents who can help you enroll in an insurance policy. Safeguard Insurance, and any agents or employees, are not affiliated with or endorsed by the United States government, Medicare, or the Social Security Administration. We do not offer every plan available in your area, and any information we provide is limited to those plans we do offer in your area. Please get in touch with Medicare.gov or 1-800-MEDICARE to get information on all your options. When you request to be contacted about Medicare Advantage, Medicare Part D, or Medicare Supplement plans, you acknowledge that a licensed insurance agent may contact you by phone, email, mail, or in-person to offer additional assistance or to discuss all your Medicare health insurance options.

Safeguard Insurance provides content (via blog posts, YouTube videos, podcasts, eBooks, and any other manner) as a service to its readers. Safeguard Insurance does not offer legal or tax advice. Safeguard Insurance cannot guarantee the accuracy or suitability of our content for a particular purpose without a full and thorough fact finder. We are not responsible for any actions taken by users.