Questions? Give us a call

Long-Term Care

What is Long-Term Care?

Long-term care is the care you may need if you are unable to perform daily activities on your own. That means things like eating, bathing, dressing, transferring, and using the bathroom. Basically, it is the care you need when you can no longer care for yourself.

Who needs Long-Term Care?

Generally speaking, the vast majority of us will need some level of extended care services during our lifetime. Nearly every person has known someone who ended up in a Long-Term Care facility, whether voluntary or not.

Long-Term Care can often be overlooked by some financial advisors who think their clients can simply self-fund the cost of Long-Term Care without truly considering how it can devastate a portfolio quickly. Long-term care is a sneaky retirement portfolio killer.

In order for someone to truly self-fund a Long-Term Care stay and not put their financial portfolio in jeopardy of running out, they would need multiple millions of dollars in retirement assets. Most people simply do not have that much money, and if you do why would you want to lose it all when an insurance company can cover a large portion of the cost for you.

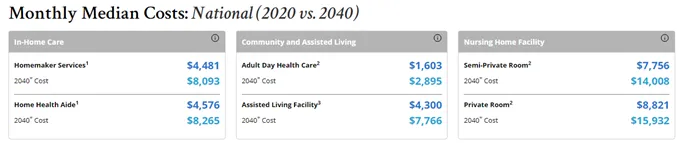

The cost of LTC continues to rise each year.

This is why it is so crucial to not overlook this important step in your financial portfolio. Don’t make the misassumption that you will be fine in a Long-Term Care scenario because more than likely if you do not plan properly it can ruin your retirement years.

Medical inflation is far more devastating than regular inflation and the costs of medical services will continue to rise at alarming rates.

Keys to Long-Term Care:

Long-Term Care Settings

LTC is more than the picture you have in your head of your sweet granny sitting alone in a nursing home.

LTC can take place in five LTC settings: Nursing home, at-home, community-based care, independent living, or assisted living.

Relying on Medicare and Medicaid alone is NOT a plan

Relying on Medicare and Medicaid alone is NOT a plan most people want to rely on for long-term care – and many aren’t eligible anyway.

Medicare does not pay for LTC.

Medicaid only pays for LTC for very low-income patients.

In most states, applicants must only have $2,000 or less of assets and very limited income.

There is a 5-year lookback period you must pass to be eligible for Medicaid.

Being eligible for Medicaid does not guarantee LTC; there may be bed shortages or waiting lists.

You have no control of the facility you are placed in once a bed is available.

The facility could be far away from family and friends.

Long-Term Care Solutions

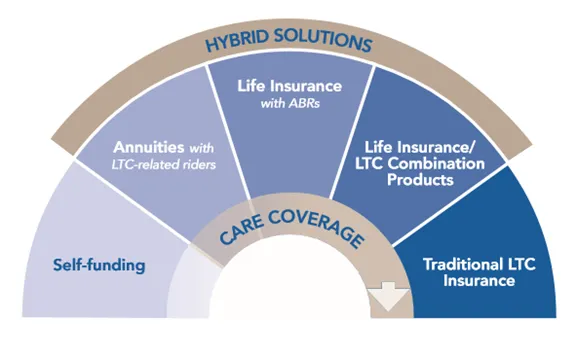

Self-funding

Though it is not likely the most cost-effective way to cover your long-term care needs it is an option for those who have five million or so saved up for retirement assets.

Hybrid Solutions

Now the most common way to cover LTC is a rider can be added to annuities or life insurance. In a hybrid product, you have a death benefit, as well as an LTC benefit if you cannot complete 2 of the 6 activities of daily living (ADLs). This takes away the risk of not using the benefits you have paid for.

Traditional LTC Insurance

Traditional LTC insurance plans have been vastly improved over the years. These plans now offer a Return of Premium Rider, which protects against the “use it or lose it” version of LTC insurance. There have been vast changes to legacy LTC plans that have improved and corrected the previous generations’ LTC issues and made these products extremely useful.

Long-Term Care Strategy Consultation

We have helped thousands of clients and we want to help you too. Don't make the mistake of waiting until it is too late.

It cost you nothing to learn more about Long-Term Care and get a quote.

Safeguard Insurance, LLC

Copyright 2022 -- All Rights Reserved

Insuring your health, life, and retirement.

Phone: 270-904-6070

Email: education@safeguardky.com

1600 Scottsville Rd, Suite 100

Bowling Green, KY 42104

The information presented on this website is for informational or illustrative purposes only. Safeguard Insurance is operated by licensed insurance agents who can help you enroll in an insurance policy. Safeguard Insurance, and any agents or employees, are not affiliated with or endorsed by the United States government, Medicare, or the Social Security Administration. We do not offer every plan available in your area, and any information we provide is limited to those plans we do offer in your area. Please get in touch with Medicare.gov or 1-800-MEDICARE to get information on all your options. When you request to be contacted about Medicare Advantage, Medicare Part D, or Medicare Supplement plans, you acknowledge that a licensed insurance agent may contact you by phone, email, mail, or in-person to offer additional assistance or to discuss all your Medicare health insurance options.

Safeguard Insurance provides content (via blog posts, YouTube videos, podcasts, eBooks, and any other manner) as a service to its readers. Safeguard Insurance does not offer legal or tax advice. Safeguard Insurance cannot guarantee the accuracy or suitability of our content for a particular purpose without a full and thorough fact finder. We are not responsible for any actions taken by users.