Questions? Give us a call

What does Original Medicare cost?

Premium-free Part A:

Generally, most people do not pay a monthly premium for Medicare Part A (Hospital Insurance) coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A."

You can get premium-free Part A at 65 if:

• You already get retirement benefits from Social Security or the Railroad Retirement Board.

• You are eligible to get Social Security or Railroad benefits but have not filed for them yet.

• You or your spouse had Medicare-covered government employment.

If you are under 65, you can get premium-free Part A if:

• You got Social Security or Railroad Retirement Board disability benefits for 24 months.

• You have End-Stage Renal Disease (ESRD) and meet certain requirements

Part A Premiums:

Part A premiums - If you do not qualify for premium-free Part A, you can purchase Part A.

People who buy Part A will pay a premium of either $259 or $471 each month in 2022 depending on how long they or their spouse worked and paid Medicare taxes. If you choose NOT to buy Part A, you can still buy Part B.

Part A Out of Pocket Costs:

Hospitalization:

• $1,556 deductible for each 60-day benefit period

• Days 1-60: $0 coinsurance

• Days 61-90: $389 coinsurance each day

• Days 91 and beyond: $778 coinsurance per each "lifetime reserve day" after day 90 for each benefit period

• Beyond lifetime reserve days: You pay all costs

Skilled Nursing Facility Benefits:

• Days 1-20: $0 per day

• Days 21-100: $194.50 per day

• After day 100: You pay all costs

Part B Premiums:

You pay a premium each month for Part B. Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these:

• Social Security

• Railroad Retirement Board

• Office of Personnel Management

If you do not get these benefit payments, you will receive a quarterly bill.

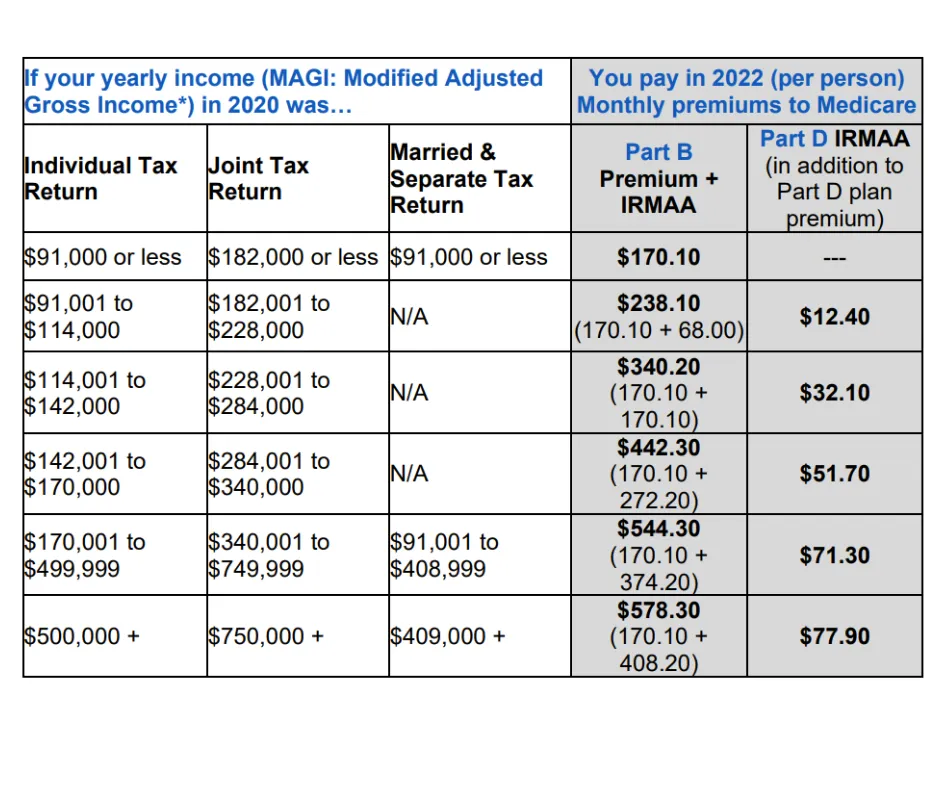

Most people will pay the standard premium amount. If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS

In 2021 the standard Part B premium amount is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you will pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). Income from 2 years ago is used because oftentimes that is the most recent full tax return the IRS has reported.

IRMAA is an extra charge added to your premium by the Social Security Administration. The new Part B premiums are released by Medicare the first week of November each year. Use the chart below to see if you will be subject to a Part B IRMAA.

In certain circumstances, you can request a redetermination of an IRMAA. If you are unsure why you are paying an IRMAA you would need to contact the Social Security Administration for clarification. If you have experienced a life-changing event Social Security can revisit its decision to access an IRMAA, or if the information being used is outdated or incorrect.

Social Security considers these situations to be life-changing events:

• Death of a spouse

• Marriage

• Divorce (or annulment)

• You or your spouse stopping work or reducing the number of hours worked

• Loss of pension

• Involuntary loss of income-producing property (due to natural disaster, disease, fraud, or other circumstances)

• Receipt of the settlement payment from a current or previous employer due to closure of bankruptcy

You can make a case with Social Security about outdated or incorrect information if:

• Filed and amended tax return with IRS

• Have a tax return showing you are receiving lower income than previously reported

Part B Out of Pocket Costs:

• Part B Deductible: $233.00 per year

• Part B Co-insurance: 20% co-insurance after the deductible is met

There is no maximum for what you can spend if you are only covered by Original Medicare Parts A and B.

Late Enrollment Penalties:

If you do not elect to sign up for Part B or Part D when you are first eligible you will likely be accessed a Late Enrollment Penalty (LEP). The premium will go up 10% for each 12-month period that you could have had Part B, but did not sign up. You can be accessed a Part B, a Part D, or both a Part B and Part D penalty. It is important to be aware of these penalties so you can avoid spending unnecessary money for the rest of your life.

*It is important to know that these numbers change every year.

Safeguard Insurance, LLC

Copyright 2022 -- All Rights Reserved

Insuring your health, life, and retirement.

Phone: 270-904-6070

Email: education@safeguardky.com

1600 Scottsville Rd, Suite 100

Bowling Green, KY 42104

The information presented on this website is for informational or illustrative purposes only. Safeguard Insurance is operated by licensed insurance agents who can help you enroll in an insurance policy. Safeguard Insurance, and any agents or employees, are not affiliated with or endorsed by the United States government, Medicare, or the Social Security Administration. We do not offer every plan available in your area, and any information we provide is limited to those plans we do offer in your area. Please get in touch with Medicare.gov or 1-800-MEDICARE to get information on all your options. When you request to be contacted about Medicare Advantage, Medicare Part D, or Medicare Supplement plans, you acknowledge that a licensed insurance agent may contact you by phone, email, mail, or in-person to offer additional assistance or to discuss all your Medicare health insurance options.

Safeguard Insurance provides content (via blog posts, YouTube videos, podcasts, eBooks, and any other manner) as a service to its readers. Safeguard Insurance does not offer legal or tax advice. Safeguard Insurance cannot guarantee the accuracy or suitability of our content for a particular purpose without a full and thorough fact finder. We are not responsible for any actions taken by users.